Go directly to:

Project Veenland focuses on restoring degraded peatlands in Germany, with the aim of increasing CO₂ storage and restoring the water system.

By raising the groundwater level and applying nature-friendly water management, the decomposition of peat is halted, and with it the CO₂ emissions that would otherwise be released during oxidation. An important part of this is the restoration of Sphagnum moss, the peat-forming moss species that retains water, enables new peat formation and stores carbon naturally. This creates a resilient landscape with space for marshes, reeds, herbs and native flora and fauna. The restoration of peatlands improves biodiversity, water regulation and climate resilience. Through Project Veenland, every investment contributes to lasting ecological impact. You can read more in the information brochure.

Impact & Return

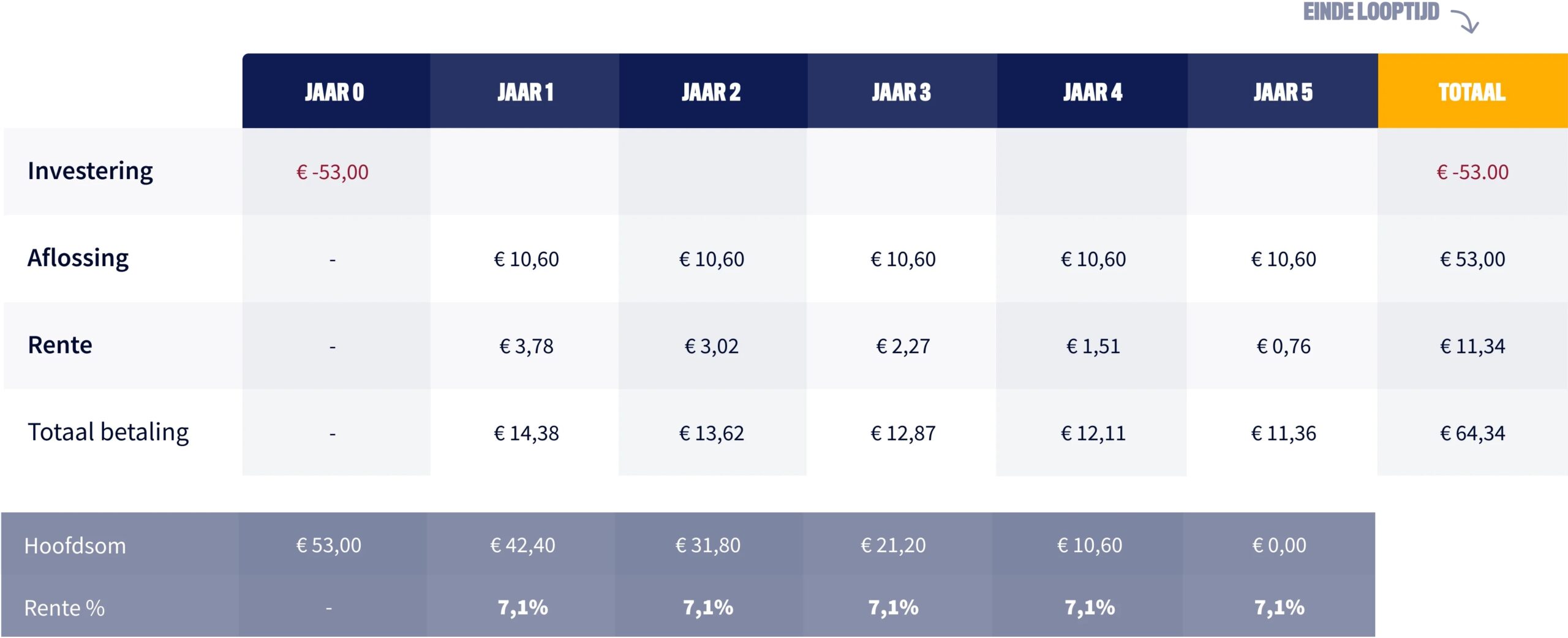

Attractive expected return of 7.1% per year

.

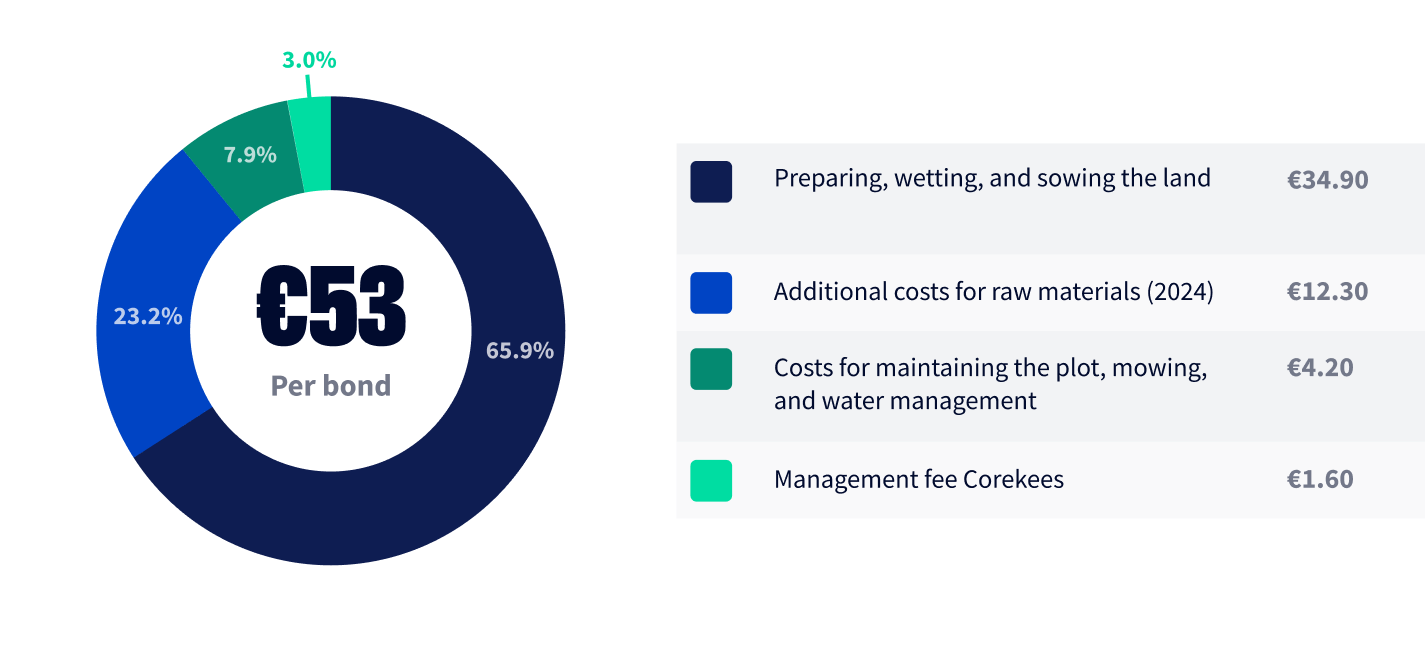

Where does your money go?

HOW THE PROJECT peatland WORKS

News about Project VEENLAND

Project Peatland Webinar

We organised a webinar dedicated to Project Peatland.

Download the brochure (NL)

The brochure provides more information about Project Peatland. After filling in your details, we will send it immediately via e-mail. Nice and easy!

Frequently asked questions

How do I know that my money is going to the right place?

For Project Veeland, we are collaborating with ZukunftMoor. This German company was founded in 2022 with a clear mission: to reduce CO2 emissions from drained peatlands by offering farmers/landowners a new source of income in the form of Sphagnum Moss cultivation.

The business case for ZukunftMoor consists of two revenue streams: growing, harvesting and selling Sphagnum Moss, and generating CO2 certificates, the renowned MoorFutures, by reducing CO2 emissions on the Sphagnum Moss farms.

They have partnered with scientific institutions to enable the desired scale-up of Sphagnum Moss cultivation: the Greifswald Moor Centre and the Succow Foundation.

Who buys the Sphagnum moss?

As the sphagnum moss market is still emerging, our local project partner is in intensive discussions with major players in the potting soil industry. They have agreed a Letter of Intent (LOI) with the current market leader, Klasmann-Deilmann. This confirms certain sales prices and expresses the intention to purchase the moss when it becomes available.

In addition, the selling prices have been confirmed by six of Germany’s largest potting soil companies.

In which way is this project sustainable?

By keeping peatlands wet, we prevent the decomposition of peat and thus the emission of carbon dioxide (CO₂).

In addition, wet peatlands are an attractive environment for vegetation and fauna. Forty per cent of all animal species worldwide depend on wetlands.